On March 15, 2009, in “Bargaining down the medical bills”,

I told the story of my hernia surgery – outpatient, in at 7 am, home by noon – and the $10,000 hospital (not doctor) charge. My insurance company paid $1,600, told me to pay $400, and the hospital wrote off the $8,000 as “contractual adjustment”. But if I was uninsured I would have gotten a $10,000 bill!

That was outrageous. Not so much the amazingly high charge, rather the fact that they were willing to accept $2,000 from an insured person, while they would have dunned and bankrupted an uninsured one, someone more likely to have less money! Of course, that would only be true if they had agreed to do such an elective surgery on an uninsured person in the first place.

Things have, apparently, not gotten better. Maybe worse. I recently had another outpatient surgical procedure (different hospital, different town) and the hospital – again, not doctor’s – charge was over $69,000! I was there for a few hours! Now I have Medicare, and a Medicare supplement plan, so I paid none of it. Medicare paid $2400, 80% of their approved charge for that procedure, and the supplement plan paid the rest. But $69,000 as a charge? I thought that the old one, charging $10,000 for a procedure that the insurer would pay $2000 for, was bad, but charging $69,000 for a procedure that you know Medicare has approved for less that 4% of that? What is the point?

Maybe an billionaire, or a royal from another country, will

show up at this hospital and be willing to pay $69,000 in cash. Dream on. But

the vast majority of the people that you would bill this amount would be

uninsured because they couldn’t afford insurance. And the hospitals do not expect

to collect anywhere near that amount from them, but they will keep billing

them, and ruin their credit, and eventually sell off the bill to a collection

agency for about 10 cents on the dollar. That agency will increase the dunning.

So what is the point of having such a high charge on the “chargemaster” (the name for the pricelist no one sees) if the only people who are going to be billed that much are those who are least likely to be able to pay? There has to be a reason, and there are in fact several, which include hoping that some insurer will, if not pay the whole amount, pay a fixed percentage of the billed charge, and so the higher the charge, the higher the reimbursement. But, of course, this makes no sense with Medicare (which has fixed approved charges that it will pay for procedures regardless of what the institution charges) or with insurers for which they have already negotiated reimbursement; in fact, the latter is usually determined as a “multiple of Medicare”, e.g., 2 or 3 times what Medicare pays. There are other arcane reasons, many of which have to do with the complex interplay between the “providers” (hospitals) and the payors (insurance companies), and who has the most clout in a certain area in a given situation. Assuredly, the interest of the patient does not enter into this discussion.

[I was going to add the following paragraph as a comment, but I thought it belonged here...]

Trying to find a pricelist with any meaning is almost impossible, but it doesn’t have to be that way. I go to the dentist in Mexico (I don’t have, but it accepts, US dental insurance). They can tell you before they do anything exactly what it will cost. Cleaning, $60. Gum trimming, $160. Same for repairing cavities, making crowns (on site, in an hour) or implants. No surprises. In the US, not even the doctors or hospital administrators know what the actual price will be for the patient.

This absurd pricing is yet another example of a “healthcare” (or maybe “healthdon’tcare”) system that is predicated on making money for the power players, and the technical details about which of them benefits most (sometimes, in the case of inner-city and rural hospitals, suffers most) dominates the policy discussion and political rule making. Politicians like to talk about regulating health insurers (and sometimes hospitals), and for sure drug companies because of their exploitation of patients. They rarely, however, do anything much about it. When they do something, it almost always 1) is very watered down by “compromises” with the big-contribution lobbyists from the regulated industries, and 2) when it does help people by reducing their cost, it always continues to make money for the (maybe) regulated companies, just a little less exorbitant than before.Drug costs are a prime example of both. The legislation that created the Medicare drug plan (Medicare Part D) passed during the George W. Bush administration. The positive benefit to patients was that, prior to it, many Medicare patients did not have coverage for their prescription drugs and often went broke trying to buy them; it required all Medicare recipients to have a plan. The obvious benefit to the corporations was that now all Medicare recipients had to buy drug coverage from an insurance company, and drug companies would now get paid for all these people’s medications. A less obvious, but incredibly important benefit to drug manufacturers was that the Part D legislation forbid Medicare from negotiating drug prices! So big bonus – everyone has to have drug coverage and they have to pay what we charge! Medicare is the only civilian purchaser of drugs (and other healthcare services) large enough to force prices down, as they do for hospital services (see the anecdotes at the start of this piece). But that they might do the same for drug prices really worried Big Pharma – after all, the VA and TriCare, the only other purchasers big enough to have real clout, did negotiate lower drug prices for their members, and this decreased their profits. Indeed, in most states Medicaid negotiates drug prices, and the manufacturers don’t like that at all. Luckily (for them), they have hundreds of highly paid lobbyists in DC, and make millions in contributions to politicians, so they were able to get this great deal. A great example is former Rep. Billy Tauzin (R, LA) who was chairman of the House Energy and Commerce Committee when Part D was passed, and, “On January 2005, the day after his term in Congress ended, he began work as the head of the Pharmaceutical Research and Manufacturers of America (PhRMA). a powerful trade group for pharmaceutical companies.” (Wikipedia)

Drug company profiteering is also a good example of the second point, that drug companies always continue to do fine and make big profits even after a reform has decreased them a little. A more current example is the push (including from the Biden administration) to lower the cost of insulin, a drug that is literally a daily necessity of life for those with Type 1 diabetes and very commonly needed for the much larger number of people with Type 2 diabetes. The 2020 Prescription Drug Pricing Report from the Office of the Assistant Secretary for Planning and Evaluation of the U.S. Department of Health & Human Services states that

The average gross manufacturer price for a standard unit of insulin in 2018 was more than ten times the price in a sample of 32 foreign countries:$98.70 in the U.S., compared with $8.81 in the 32 non-U.S. OECD countries for which we have prescription drug data. The U.S. prices for the mix of insulin used in the U.S. were 8.1 times prices paid in all non-U.S. OECD countries combined. !!

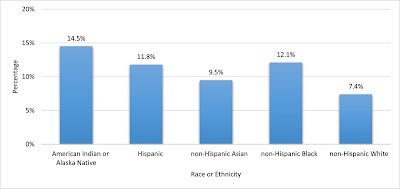

Verywell Health reports that “As of March 2022, the price for a vial of insulin ranges from $50 to over $1,000, and a pack of pens ranges from $45 to over $600.” News organizations such as the BBC have reported on the impact of this on actual people. No wonder limiting the price of this life-saving drug is something concerning to both Republicans and Democrats. President Trump talked about it a lot, and President Biden is actually moving to limit the cost. With the administration-backed Inflation Reduction Act, not only did the price get controlled, but Eli Lilly (one of the 3 major manufacturers of insulin for the US, along with Sanofi-Aventis and Novo Nordisk, and the company that was given the patent for insulin from Banting and Best for $1) announced a 70% reduction in their charges. The White House briefing fact sheet on this legislation’s effect is interesting, and contains some information on who in the US has diabetes. The answer is a lot of people, over 11% of the US population, and minority groups, the poor, and the poorly educated have an even greater burden of this disease.

But don’t cry for Eli Lilly, or the other insulin, or any drug, manufacturers. That they will be doing fine and continuing to make huge profits after the price restrictions go into effect is further evidence that before they were making outrageous, unjustifiable, and indeed (given that insulin is needed to keep many people alive) murderous profits.

It is hard to discuss rapacious profiteering in health(don’t)care without drug companies, but let us not lose sight of the fact that the insurance companies and the big hospital and “health systems” are also making out like bandits, ripping us off, and endangering our health.